Desperate Times

August 11, 2022Insurance Fraud in an Economic Recession

Author: Olivia Maxwell

The past few years have undoubtedly challenged both industries and individuals in a variety of ways. But as many of us attempt to return to a sense of normalcy, there are some lasting changes that are just too difficult to ignore. Price increases, labor shortages, supply chain disruptions and geopolitical unrest have left many of us questioning if an economic recession is imminent.

According to the National Bureau of Economic Research, formally, we are not in a recession at this time. The indicators of a recession include quarterly Gross Domestic Product (GDP), unemployment rate, housing prices, stock prices, income level, and manufacturing industry health. To officially be in a recession, our nation must undergo deterioration for more than two consecutive quarters – deterioration that is measured based on the aforementioned indicators. Today’s economic conditions are setting off alarm bells for many Americans who experienced our most recent official recession, The Great Recession of 2007-2009. That all-too-familiar perfect storm is brewing, and the pressure is building as families figure out how to weather it.

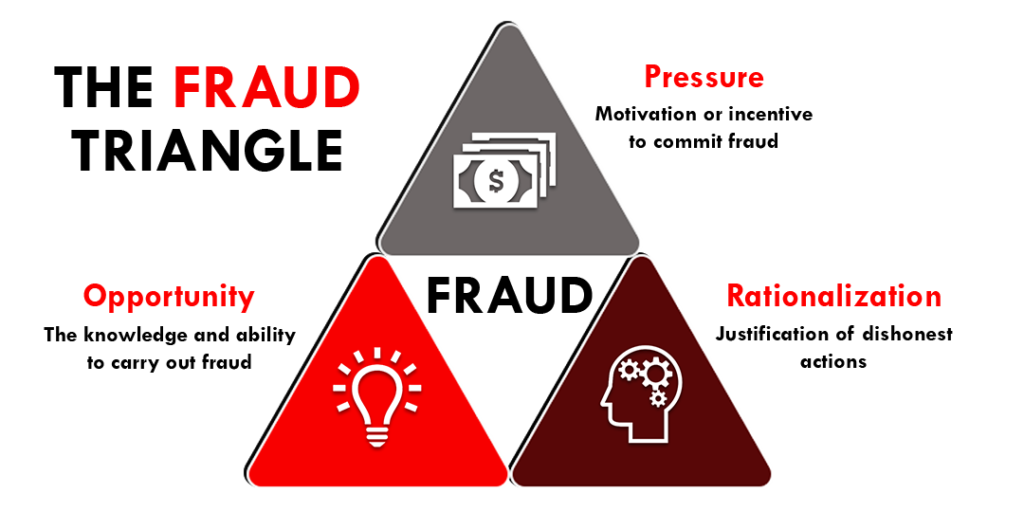

That pressure is the first piece of what experts call the Fraud Triangle. Coined by Dr. Steve Albrecht, the Fraud Triangle theory is used to explain the reasoning behind an individual’s decision to commit fraud by resolving the “why” and the “how.” The framework of the Fraud Triangle involves three components: (1) a perceived pressure, usually due to financial stressors; (2) rationalization; and (3) an opportunity to actually carry out the fraud. We see those three elements more frequently during economic downturns and recessions as financial strain becomes more prevalent and people feel they are forced to take drastic measures to stay afloat. That first element, pressure, may present itself in the form of wanting to maintain one’s lifestyle despite inflation and rising costs of living. Wide-scale layoffs are also more common during recessions, and people will face pressures when paying bills. Regardless of the specific reason, pressure inevitably increases during recessions as people struggle to meet their basic needs.

With the economic trajectory looking grim and pressure mounting, many will feel forced to seek out alternative sources of income to take care of themselves and their families. For some, those alternative sources may not be legitimate. Economist Gary Becker, a Nobel laureate, developed a theory that, in some cases, committing a crime was a rational decision – that a person would only commit a crime if the expected utility exceeded that of using his time and other resources in pursuit of alternative activities, such as leisure or legitimate work. Financial hardship causes more people to justify things that they may not normally do, such as abuse their insurance policies, exaggerate a claim, or fake a claim entirely for their own personal gain. This justification, or rationalization, is the next piece of our Fraud Triangle. People are more likely to rationalize their dishonest behavior if they feel they have no other choice. They may even feel that it “doesn’t hurt anyone” or that they are somehow entitled to a financial gain.

Along with the anticipated increase in fraudulent claims during a time of economic uncertainty, legitimate insurance claims are also likely to rise in response to financially-motivating crimes, such as theft. Now, more than ever, it is important for those in the insurance industry to stay vigilant. However, it is also in the realm of possibility that claims professionals will have to cut costs of their own during tough times, whether that is through downsizing, layoffs, or reducing investigation costs. This combination of more claims and fewer resources leads us to the third piece of our Fraud Triangle: opportunity. Frauds who have the knowledge and ability to carry out their insurance scams will now also have less oversight while claims professionals are spread thin.

Insurance crimes are not victimless crimes, and these actions are never justified. As investigators, we are well-equipped and prepared to help you get to the bottom of those questionable claims and determine when it’s time to engage the SIU. Through our SIU & Fraud Abatement Program, we can also educate you on how to identify red flags as well as those situations where the pressure, rationalization, and opportunity have turned an ordinary claimant into an overnight fraudster.

Hard times for some can mean desperate times for others. But a strong collaboration with your investigation agency will help you remain tough on fraud while we all navigate the uncertain economic future.